Serum Institute looking for a $1 billion shot to fight covid, talks on with Blackstone, KKR and others

The company, privately owned by Cyrus Poonawalla and his son Adar Poonawalla, plans to float a special purpose vehicle (SPV) for its vaccine candidates, ET has learnt. The amount raised would go to this entity and not to SII. The company expects to close the fundraising exercise by September.

MUMBAI: Serum Institute of India (SII), the world’s largest vaccine manufacturer, is in talks with private equity investors including Blackstone and KKR as well as philanthropists and social venture funds to raise up to $1 billion for Covid-19 vaccine development, said two people aware of the matter.

The company, privately owned by Cyrus Poonawalla and his son Adar Poonawalla, plans to float a special purpose vehicle (SPV) for its vaccine candidates, ET has learnt. The amount raised would go to this entity and not to SII. The company expects to close the fundraising by September.

“We are in talks with a few investors but there is no comment beyond that,” said an SII spokesperson. Blackstone, KKR spokespersons declined to comment.

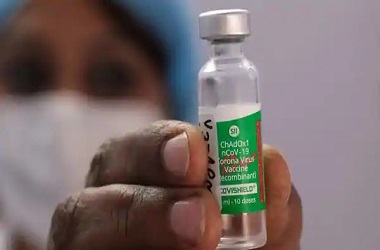

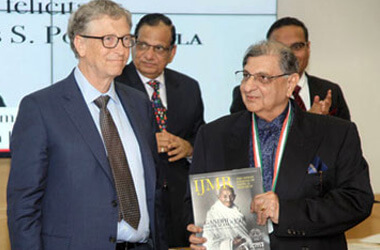

SII received $150 million earlier this month from the Bill & Melinda Gates Foundation for development and distribution of the AstraZeneca-Oxford University vaccine candidate as well as that of US biotech firm Novavax for low- and middle-income countries. SII has plans to manufacture 100 million doses every month and 400 million doses of the Oxford vaccine by the end of this year.

Goldman Sachs, Citi and Avendus will manage the fundraising exercise, said the people cited above. SII has invested close to $200 million for the AstraZeneca-Oxford vaccine at “personal risk”, SII CEO Adar Poonawalla told ET in an interview in July. The company hadn’t received any funding or reached advance purchase agreements with the Indian government, he’d said, adding that the aim was to focus on getting the necessary approvals to conduct trials and start manufacturing the vaccine.

“So far we have five candidates, including two of our own. We might explore partnership with two more, which we can't talk about at this stage,” he had said. Besides the AstraZeneca-Oxford tie-up, SII’s pipeline also includes its own candidates, among them a Covid-19 vaccine in partnership with US firm Codegenix.

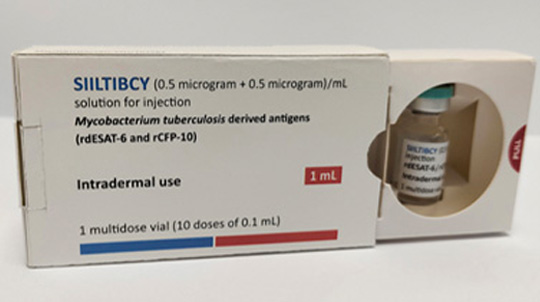

The company is also working on a trial to determine the efficacy of the BCG vaccine against the disease. Last week, the AstraZeneca-Oxford candidate received permission to start Phase 2 and 3 trials in India. In the Novavax agreement, SII has an exclusive licence for development, co-formulation, filling and finishing, registration and commercialisation of the NVX-CoV2373 vaccine product for the SARS-CoV-2 virus for India. Novavax trials are yet to start in the country.

Five years ago, SII had approached private investors for a similar-sized fundraise for a 10% stake in the parent at a $12 billion valuation. Talks were called off subsequently. While the company blamed market volatility for that decision, investors were hesitant about the premium valuation sought and lack of liquidity options such as an IPO.

The race for a global vaccine for Covid has however transformed industry dynamics. Indian companies have attracted partnerships due to the scale of manufacturing that the country offers. SII has exclusive agreements with AstraZeneca and Novavax.

The company sold its manufacturing facility in the Czech Republic to Novavax earlier this year. Hyderabad-based vaccine manufacturer Biological E recently announced a manufacturing deal with Johnson & Johnson to produce close to 400 million doses of the latter’s vaccine candidate.

Source - The Economic Times

ABOUT US

OUR COMPANIES

CORPORATE SOCIAL RESPONSIBILITY

© Copyright 2026. Cyrus Poonawalla Group. All rights reserved.